It is dream for many Indians to look for job opportunity outside India. Specially migrating to Canada, New Zealand, UK, USA, Dubai and Singapore. You may have seen many blogs on how to migrate. This post is not about “how to” but “why to” migrate. Is it worth the “money”?

Software Professionals – Dream to migrate out of India ?

One of the primary motivations behind this thought process is to earn more money. There are many other potential reasons, such as education, quality of life, family, social status, and opportunities. We frequently see advertisements about immigration to countries like New Zealand and Canada. There are also numerous Google searches like “How to get a Green Card in the USA” and “Where are Canadian Consulates in India.”

Migration for better financial opportunities is a significant factor for individuals moving to developed countries. People often compare the conversion rates of of currencies like USD, CAD, GBP, EUR, NZD, AED, or SGD to INR to evaluate potential salaries. The higher value of these currencies in comparison to Indian Rupees makes foreign salaries more attractive. For example, a monthly salary of 5,000 USD is equivalent to around 4 lakh Rupees in September 2023. These comparisons are based on foreign exchange rates, which are also used for money transfers.

However, the situation changes when we use this salary to buy goods or services in the respective country. Money is only valuable when used to purchase goods and services; otherwise, it’s just a number or a piece of paper. The COVID-19 pandemic has highlighted this lesson clearly. This concept is commonly referred to as “Purchasing Power Parity” (PPP).

What is PPP?

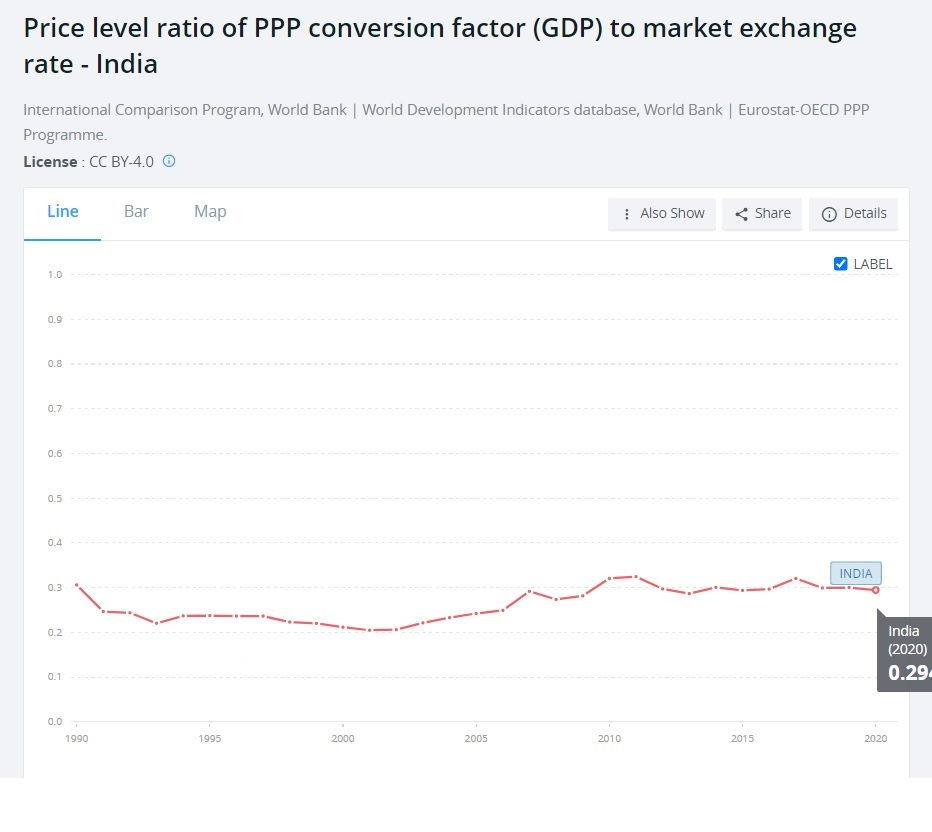

In simpler terms—imagine your mother has given you a list of items and services to buy from the market. The money spent in both countries is considered equivalent. For example, if you spend 1,000 USD in the USA and for the same list you spend 22,500 Rupees in India, both amounts provide the same value. This means 1,000 USD is equivalent to 22,500 Rupees. This ratio of 22.5 is the real conversion rate. From a price point parity perspective, 1 USD is equivalent to 22.50 INR. In 2023, this was around 24 INR, meaning that 24 Rupees can buy in India what 1 USD can buy in the USA. For reference, you can check the Purchasing Power Parities (PPP) data on the OECD website: https://data.oecd.org/conversion/purchasing-power-parities-ppp.htm. In India, most goods and services are generally available at a 70% discount compared to other developed countries. This means that the real value of 1 USD is approximately 24 INR.

Value of Remittance

The cost of items can vary. When considering your average spending over 3 to 4 years, the overall cost in India is around 70% of what it would be in the USA. This takes into account both goods and services. In simple terms, goods and services bought in the USA for USD 500,000 over 5 years would cost approximately 1.25 Cr in India during the same period. However, if you bring this money to India, 500,000 USD will become 4.2 Cr (as of September 2023), and you can buy all the goods and services for 1.25 Cr and still save 3 Cr.

If you plan to spend 2 years in the USA and want to maximize your savings and bring them back to India, all your savings will convert as per the Forex rate. However, if you consume those savings in the USA, you will get value based on USA terms. For example, 100 USD brought to India will be equivalent to 8,300 INR. Money consumed in the respective country gives value as per PPP, whereas money transferred gives value as per the Forex rate. 1,000 USD consumed in the USA will be equivalent to 24,000 Rupees worth. However, if that money is sent to India, it will become 84,000 Rupees.

I apologize for any confusion. It is important to understand concepts like PPP and conduct thorough analysis before making such a significant decision.

In some countries, goods and services are even more discounted. For example, in Sudan, you can buy the same things at a 90% discount compared to the USA, meaning India is three times more expensive than Sudan.